Honda Motor Co. (HMC) has long been an automaker whose vehicles - cars and motorcycles - scored high in customer satisfaction surveys and in reviews. Its record as an investment has been rather disappointing.

The prospects for Honda shares could be in for a reversal if some massive changes to the company's structure bring about efficiencies that management is seeking. The most important restructuring is the dismantling of Honda's R&D subsidiary to merge product development with the main automobile subsidiary. Previously, Honda R&D developed new models separately, a process the company now says is inefficient.

According to Nikkei, which reported on the restructuring, roughly 10,000 Honda R&D employees of the 14,000 total will be transferred to Honda Motor. Starting April 1, Honda's SEDB structure in which sales, engineering, development, and buying (purchasing) operated autonomously while cooperating with each other now will be integrated to operate as a whole.

Late to the trend

The trend within corporations to move from functional silos toward integration is decades old, though one that Honda had resisted.

"We needed drastic reform for our survival," Honda R&D President Toshihiro Mibe said in early April. The company has been reforming corporate practices since 2015 but left R&D untouched because its establishment as an independent entity dated to the company's founder and was seen as sacrosanct. According to Nikkei, current and former Honda employees have objected to R&D's integration.

Honda's global car models Source: Honda Motor Co.

For the fiscal year through March 2020, the automobile business's operating profit fell 27% on the year to 153.3 billion yen and its operating profit margin was as low as 1.5%. The unit logged an operating loss of 75.6 billion yen in the January-March quarter of 2020, according to Nikkei.

Honda shares (in dollars) Source: Yahoo Finance

Honda's motorcycle business, though smaller, is highly profitable and generally supports the company's overall profitability.

A former CEO, Takanobu Ito, had hoped to increase profitability following the global financial crisis by greatly expanding automobile production and market share worldwide, an initiative that failed in part due to slippages in quality and in part because of the distraction of a crisis brought about by defective and potentially deadly airbag systems, discussed below.

The current CEO, Takahiro Hachigo, is credited with an integration project of development, procurement, and manufacturing that resulted in the highly successful Honda N-WGN minicar.

Rising Star

Honda burst on to the automotive scene in the 1970s and 1980s amid acclaim for its Civic and Accord sedans that scored high in value, fuel efficiency, and quality. The company already had made a name for itself in motorcycles and further improved its reputation by becoming the first Japanese automaker to manufacture in the U.S., first motorcycles and then cars.

Eventually, snow blowers, lawnmowers, and even a business jet carried the Honda name. The company prided itself on its independent viewpoint on design and engineering, proving with its CVCC engine that it could meet air quality standards without a catalytic converter. When rivals were introducing bigger and ever more powerful V8s, Honda decided that six cylinders were plenty - now those rivals have joined Honda, making V8s an endangered species.

Following the global financial crisis, events went sideways for Honda. First, a tsunami in Japan disrupted domestic production and then, floods in Thailand overwhelmed its assembly plant in that country. Honda was among many automakers forced to recall airbags made by Takata when it was discovered that the inflators could explode and kill or injure vehicle occupants.

Faulty airbags can kill

Honda said it knew of 100 people killed and many more injured by faulty airbag deployments. Included in the costs of the airbag debacle was a $605 million payment to settle a class action lawsuit against the company.

Along with the dismantling of organizational silos that have slowed down the company, Honda is determined to reform its previous "go it alone" philosophy when developing major new technologies such as battery-powered EVs. Starting in April, Honda joined forces with General Motors Co. (GM) in the field of battery development to support two all-new electric vehicles for Honda based on GM's highly flexible global EV platform powered by proprietary Ultium batteries.

Additionally, in 2018, Honda disclosed that it will invest $2.75 billion over the next twelve years in Cruise, GM's driverless vehicle subsidiary. Initially, the two automakers will collaborate on "a purpose-built autonomous vehicle that can serve a "wide variety" of use cases and be manufactured at high volumes for global deployment," according to The Verge.

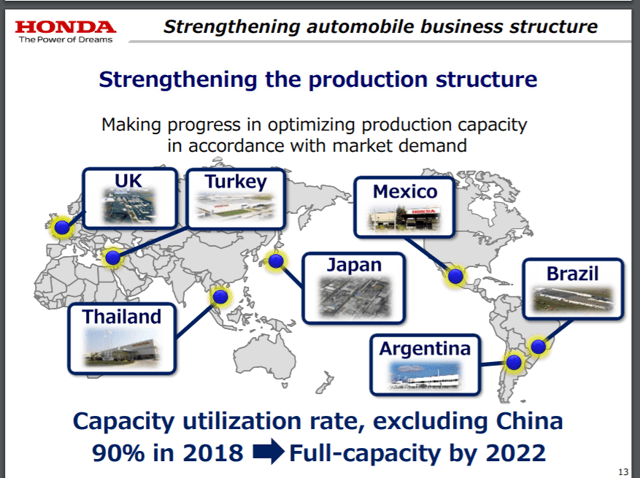

Honda global capacity utilization goal - source: Honda

With Honda plants running at an aggregate of about 90% of capacity in 2018, profitability has been strained. The automaker intends over the next two years to reduce capacity to about 5.1 million units globally from the current level of about 5.6 million units, the 480,000 fewer units coming from operations in Japan, UK, Turkey, and Argentina. The goal is to be building cars at full capacity - and much more profitably - by 2022.

For the thoughtful investor, the question is whether the latest initiative can reverse the unfortunate downward trend in Honda's equity price for the past nine years. Much is riding on Hachigo's reform program, with some optimism to be derived from his earlier success championing Honda's minicar business, which many had thought the company would exit.

Assuming no more tsunamis, floods, or (heaven forfend) exploding airbags, Honda should be able to prove tangible results within a year or so. For the moment, I would watch Honda's financial results closely with an eye toward getting on board when improvement is obvious. In that event, other investors should notice as well.

If you found this article interesting and informative, please consider following me.

Disclosure: I am/we are long TM. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The Link LonkJuly 01, 2020 at 05:21AM

https://ift.tt/38gKxEm

Honda, Stellar Name Among Car Buyers, Restructures To Win Regard From Equity Investors - Seeking Alpha

https://ift.tt/38hkzRl

Honda